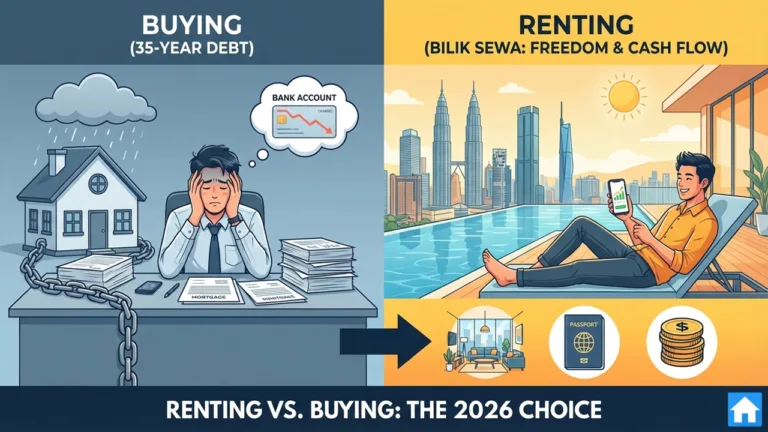

The debate over Renting vs. Buying is reaching a tipping point in Malaysia. In our parents’ generation, the path was simple: graduate, get a job, and immediately sign a 35-year housing loan. But in 2026, the Malaysian property landscape has shifted. With the MRT3 Circle Line making city living more accessible and a high supply of urban condos in areas like Mont Kiara, the “Great Malaysian Dream” is being redefined.

Young professionals are no longer asking “When should I buy?” but rather:

“Why tie myself to a 30-year debt when I can rent a lifestyle I actually enjoy right now?”

At RoomGrabs, we see the shift every day. Here is why the Renting vs. Buying debate is leaning heavily toward renting for Malaysia’s Gen Z and Millennials this year.

1. Renting vs. Buying: The Equity Myth

The biggest argument in the Renting vs. Buying saga is: “You’re just paying your landlord’s mortgage.” While that’s technically true, it ignores the Opportunity Cost.

- The Buyer: Ties up RM60,000+ in a downpayment and legal fees for a condo that might only appreciate by 2-3% a year.

- The RoomGrabs Renter: Keeps that RM60,000 in liquid investments. By renting a bilik sewa in Bangsar South for RM1,200 instead of paying a RM3,000 mortgage, they have an extra RM1,800 every month to grow their wealth.

2. Why the Renting vs. Buying Debate Favors Flexibility

Let’s be real: Most of us can’t afford to buy a luxury condo in TRX or Ara Damansara. But we can certainly afford to rent a room in one. Buying a home often means compromising on location—ending up in a “new growth area” that is a 45-minute crawl in traffic from civilization.

By choosing to rent, you get:

- Access to Premium Facilities: Sky gyms, infinity pools, and 24-hour security.

- Proximity to the “Vibe”: Walk to your favorite cafes in TTDI or your office in KL Sentral.

3. The Discovery Advantage (Finding Your Perfect Match)

Finding a room in a massive city like KL can be overwhelming. RoomGrabs.com acts as your central hub for discovery. We provide the marketplace where thousands of landlords post their rooms, giving you the power to choose what fits your budget.

💡 Renter’s Pro-Tip:

Because RoomGrabs is an open marketplace, we give you the power of choice! However, remember that the responsibility of due diligence lies with you. Always view the room in person, meet the landlord, and read the tenancy agreement carefully before making any payments.

4. Renting vs. Buying: The 2026 Monthly Comparison

| Feature | Buying (RM550k Condo) | Renting a Room (Bilik Sewa) |

| Monthly Outflow | RM2,800 (Loan + Fees) | RM900 – RM1,400 |

| Maintenance/Sinking Fund | RM350 – RM500 (Your cost) | RM0 (Landlord’s cost) |

| Repair & Leaks | “Call the plumber” (RM$$$) | “Text the landlord” (RM0) |

| Career Mobility | Stuck in one spot | Move anywhere in 1 month |

5. Flexibility as a Career Strategy

In 2026, the most successful professionals are the most mobile ones. If a dream job opens up in Cyberjaya or even Singapore, a homeowner is weighed down by a property they can’t sell quickly. A renter simply packs their bags.

Choosing a “Bilik Sewa” isn’t about “not being able to afford a home”—it’s about refusing to let a 30-year debt dictate your career moves.

The Verdict: Is 2026 Your Year of Freedom?

If you have a large family and want to paint your walls neon green, buying is for you. But if you are a young professional looking to maximize your cash flow and live in the heart of the action, renting is the smarter play.

Ready to see what’s out there? Browse thousands of room listings on RoomGrabs.com today!